The next era of

embedded finance

Integrate end to end credit and payment solutions into

your business processes using our modern card issuing

platform.

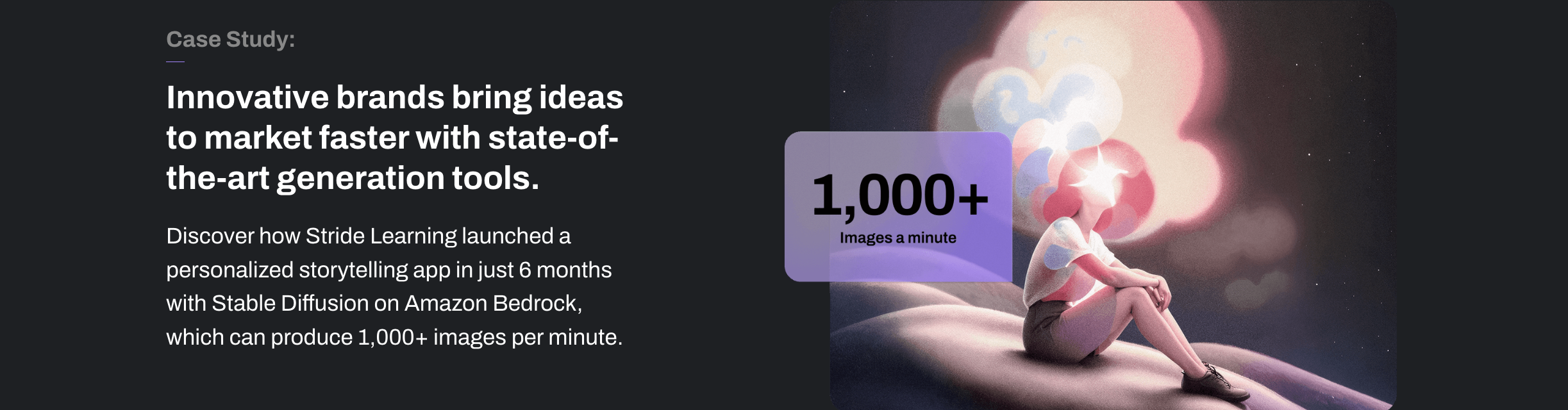

It starts with real creatives.

From global enterprises to booming startups, count on Sparks.

Products

Market

Leverage existing relationships withissuing banks, networks, and cardfulfillment providers to go live in daysnot months.

Trust

Deploy your card

program with speed.

Legacy card platforms can take months,

if not longer, to get up and running.

Sparks’s platform allows you to create

and test card programs in days, and

go live in weeks.

Protect your

customers’ data on

a secure platform.

Sparks’s platform leverages a robust,

multi-layered security architecture and

industry best practices and controls to

protect our customers’ and their sensitive

data, including meeting the stringent

requirements of PCI DSS, PCI 3DS,

SOC 1 and SOC 2 certifications.

Trusted by the world’s most innovative businesses.

Carefully tailored for you

payment experience

Flexible and scalable technology to meet your unique payment needs

Credit cards built

for your brand,not

co-brand.

Generate loyalty at every touchpoint. Create a branded consumer or commercial credit card program built for you, on a modern, flexible platform you can trust.

Branded cards build loyalty that lasts.

According to Sparks’s 2023 State of Credit Report, 50% of US consumers own a card affiliated with a brand. This year’s report delves into how credit programs open the door to cardholder loyalty.

The flexible deployment you need

to get to the outcomes you want.

Self-Host

Deploy our models in your

environment for advanced

customization and control of your data.

API

Seamlessly integrate our production-

ready media generation and editing

tools with no infrastructure to manage.

Cloud Service

Securely deploy our image generation

and editing tools through the leading

cloud services you already use.

Drive loyalty for your brand

Personalize rewards to your cardholders, using in-depth spend data and behavioral insights—earn loyalty across each and every touch point.Embed your branded credit card experience directly into your app and website to keep your customers where they belong — with you.

Embed into your brand

Don’t be bound by traditional credit offerings that put you in a box. Own the entire cardholder experience, from application to everyday spending.Provide a seamless, digital-first cardholder experience and realize superior flexibility and control, using Spakrs’s modern, API-based platform.

Remove complexity platform

Everything you need to launch and grow your program. From underwriting and bank partnerships to customer service and rewards, we have you covered.Expand into a full embedded finance offering with banking accounts and seamless money movement on a single unified platform.

"We have seen Spakrs be the trusted advisor for us on not just issuing the card, but doing the card processing and the card management. Compared to other platforms that required us to do large-scale coding, required us to take well over six months to a year to go to market, Sparks helped us do that in less than six months."

Tom Mazzaferro

Chief Data and Innovation Officer, Western Union

F.A.Q.

Find answers to commonly asked questions about our services and trading strategies

What are virtual cards?

Just like their physical counterparts, virtual cards have a 16-digit number that is automatically generated and assigned to a customer’s account. They are, in many cases, the preferred form of payment because they can be issued and used immediately. Spakrs provides virtual cards with Just-in-Time (JIT) Funding to optimize cash flow. Spakrs also makes it easier to control and track funds tied to the virtual card number.

How to safely embed cards into applications?

Securely embed sensitive card data within your app using customizable widgets. This will keep you from needing Payment Card Industry (PCI) certification. Your cardholders will securely activate their cards and set PINs within your web and mobile apps without any information being stored or exposed on your servers or during data transfer. The widgets comply with the Payment Card Industry Data Security Standard (PCI DSS).

How to manage bank cards?

Use Sparks to manage the lifecycle of your cards. Order, activate, set expirations, offset, suspend, terminate, and more. Spakrs lost, stolen, and damaged cards via APIs. Handle card fulfillment, inventory, and shipping in bulk. Use Interactive Voice Response (IVR) for card activation, PIN setting, balance inquiry, and lost or stolen card reporting.

Benefits of tokenization and digital wallet integration?

Less busywork.

More great work.

The future of creativity is here, and it’s not just a prompt. It’s people

like you, using tools like ours. So, ready to start making like nobody’s

business?